As a former Finance leader for several large manufacturing companies, I’ve seen my fair share of capital requests – both well prepared, and not so well prepared. Many lacked any quantifiable means to determine project success, and cost savings were often overpromised and/or difficult to measure. Capital Authorization Request (CAR) forms were completed with only the bare minimum information, sometimes attaching a vendor quote as the primary supporting information. As a result, CARs were often denied or kicked back to the requestor for more information.

Unfortunately, this problem plays out at companies all over the world, resulting in denied requests, with Finance perceived as the enemy. To the requestor, Finance is a detached, uncaring group locked in their ivory tower with no understanding of how the business works. Finance professionals, for their part, often take the opposing position, believing that poor proposals reflect poor thinking about a bad project, and the circle continues – poor trust results in fewer approved projects, which further erodes trust.

I’ve been fortunate to work for companies where there was a concerted effort to build bridges between Finance and other parts of the organization. To get the groups speaking the same language toward a shared goal – improving the company. When working with Operations, Finance teams were encouraged to deeply understand proposed projects. Instead of just reviewing the proposal in our offices, we would go out on the factory floor, see the process, understand the challenges and opportunities, and help identify concrete ways to define and measure project success. Additionally, we were encouraged to look at indirect risk factors that might impact the project and address them in the proposal. Lastly, we were required to have an opinion on the project. If we approved the capital request, we needed to believe in it – i.e., to put “skin in the game” by showing we endorsed the project and believed it would be successful.

With so much economic uncertainty currently, many CEOs and CFOs are reluctant to invest in new projects. They feel cash flow is too tight and the risk of investing is too high. However, sitting back and waiting for things to change is also risky. Our current challenges with COVID-19 have accelerated trends with labor shortages, worker health and safety, employee retention, and productivity, and require a different approach for companies to remain competitive. More than ever, companies are being urged to look at automation and new machinery to address these issues, but Operations teams are having a difficult time getting Finance to loosen the purse strings. We’ve worked on proposals for many promising projects with fast paybacks – often six months to a year – only to have them denied.

How can you avoid this with your critical project? In our experience, teams successful in getting automation projects approved follow a similar playbook. Here’s what it entails:

- Involve key stakeholders to define the need. Include Finance, Human Resources, IT, Marketing and/or other stakeholder groups to help clarify the problem and articulate a solution. Assess the project from multiple perspectives to show the impact on operational efficiency, product quality, employee health and safety, employee satisfaction and retention, etc.

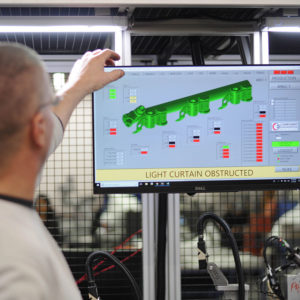

- Visualize the problem. Get the team out on the manufacturing floor to understand current processes and speak with impacted workers. Seeing the impact of repetitive tasks, heavy-lifting, and production clogs on workers both physically, and emotionally, makes the problem, and the opportunity, real.

- Quantify the problem and establish goals for each measure. By documenting and reporting the expected positive impact for each measure, i.e., improvements in cycle time, scrap reduction, reduction in injury, etc., you further validate the investment. And when your project clearly meets its goals, your subsequent capital requests will be more credible.

- Give options and consider a phased approach. By starting with a less risky, less expensive base solution, you give the team time to phase into the investment, adding to the overall solution as the positive impact of the improvements are proven out in production.

- Outline and address risks. Have your multi-disciplinary team identify potential risks, and how those risks could be mitigated. For example, there is the risk of employees not adopting the new technology. In addition to including the potential risk, indicate how machine operation will be simplified, and identify available training aids. Also include the risk of postponing the solution.

- Compete. Capital is scarce, and good CEOs and CFOs allocate it to what they perceive as the worthiest projects. Ensure that you and your cross-functional team, establish your project as a strategic priority. Link the project to your overall corporate strategy in your proposal. Engage the cross-functional team in helping to sell the proposal to upper management. “Socialize” the idea with individuals in the approval chain by walking them through it individually and bringing them out on the factory floor (if possible) to see it for themselves.

- Last, but certainly not least, see the project through your customers’ eyes. Why would they care? How does it improve your service to them?

While this list is a good starting point, it certainly isn’t comprehensive. There is much more that must be done to properly justify a project, including calculating ROIs, getting vendor proposals, etc. that will be critical to proposals success. Remember, as you’re working through the details, to not lose the forest through the trees. Embrace the approach of engaging the Finance team (and other stakeholders) along the way to develop them as advocates, rather than treating them as a gatekeeper, and you can surely increase the likelihood of approval.

Good luck!

John Amrhein

Orka Automation Partner and Guest Blogger

Additional Resources on Capital Approval:

3 Steps for Calculating Rate of Return on Capital Expenditure